Millennials are digital natives and we prefer to go online for just about anything. We find our partners online, we shop online, we order dinner online — so it only makes sense that we would bank online.

Digital banks are growing in popularity thanks to millennials’ drive for convenience and our comfort with digital products.

Millennials are also a generation grappling with large student debt, income stagnation and inflation, and online banks offer fewer or lower fees since they don’t have the same overhead costs as traditional banks.

Millennials Are Flocking to Online Banks

In Canada, online banks have been growing and proliferating, some even associated with the “Big 5”.

And the preference for digital banking is clear: 73% of millennials report they would prefer to have a digital-only relationship with their bank, and 84% already have a mostly digital relationship with their bank. Another study found that 59% of millennials use online banks or are planning to make the switch this year. Plus, many of us are already comfortable with fintech thanks to investing apps.

If you’re intrigued and want to dip your toe into the world of digital banking, here is a roundup of the best online banks for Canadians in 2021.

Best Online Banks in Canada

1. Tangerine

Originally founded in 1997 as ING Direct, Tangerine was purchased by Scotiabank in 2012. Today, they offer a simplified, innovative and safe approach to banking and remain one of the best online banks for Canadians.

The best products offered by Tangerine include:

- A savings account with an interest rate of 0.1%

- A no-fee chequing account with no minimum account balance

- A no-fee money back Mastercard

You can feel safe using Tangerine as your bank — deposits are ensured by the Canada Deposit Insurance Corporation (CDIC). You’re also able to access cash through over 3500 ABMs on the Scotiabank network. Like other fintech apps, the Tangerine user interface is seamless and easy to use.

2. Simplii Financial

In 2017, Simplii Financial was founded after initially operating as PC Financial, which was a joint venture between Loblaws and CIBC for 20 years. As the name suggests, this online bank aims to keep things simple. They offer multiple banking options with limited fees:

- A chequing account with unlimited transactions, e-transfers and no minimum balance

- A savings account with an interest rate of 0.10% with promotional offers available to existing and new customers throughout the year

- The no-fee Cash Back Visa with incentives that are perfect for restaurant goers

Related Articles

The app isn’t flashy, but it’s clean, easy to use and provides all the functionality you need. Customer support is available 24/7.

3. EQ Bank

EQ Bank launched in 2016 as a subsidiary of Equitable Group. They strive to provide simple and convenient online banking.

EQ Bank’s major offering is the EQ Bank Savings Plus account. It serves as a hybrid-savings chequing account. Users receive an ongoing 1.25% interest rate, have no minimum balance requirement and unlimited withdrawals and e-transfers. The drawback to this account is there is no debit card option so you aren’t able to withdraw cash.

Despite not being able to access cash as easily as some of the other banking options, deposits are still CDIC-insured. The app is clean, minimalistic and the sign-up process is seamless.

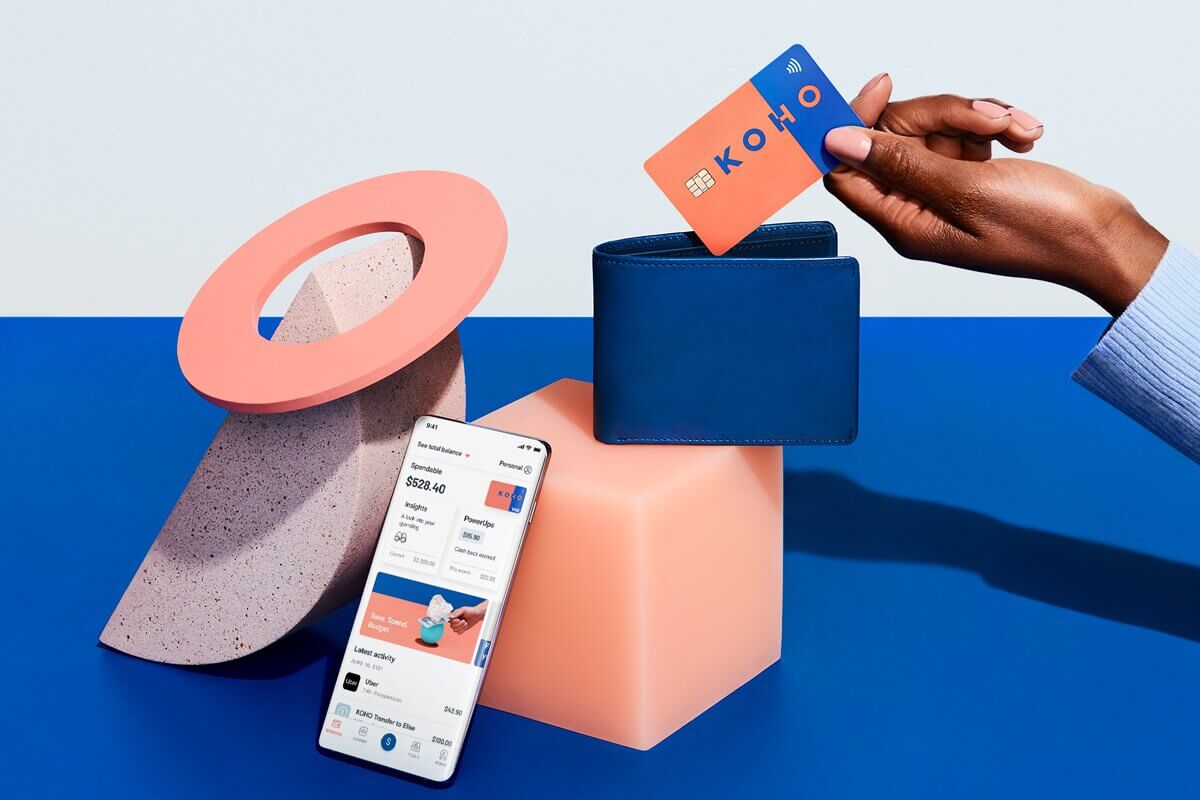

4. KOHO

KOHO is a Canadian fintech company. In partnership with Peoples Trust, it provides banking services through a mobile app that provides spending and budgeting insights as well as a prepaid Visa card. The prepaid Visa card serves as a debit card while offering you a traditional credit card perk of 0.5% cashback on every purchase.

There is no minimum limit, no promotional rates and no fees. If you set up a direct deposit, you will earn 1.2% annual interest on your entire KOHO balance, which is paid out monthly. Again, despite the lack of physical locations, you can feel comfortable putting your money here as KOHO is CDIC-insured.

The KOHO card is gorgeous, the sign-up process is easy and the app is clean and informative.

You Don’t Need to Say Goodbye to Brick-and-Mortar Banks

With the options available from online banks, there’s no reason to pay fees to maintain a chequing account or send electronic transfers.

However, brick-and-mortar banks do offer specialized financial services you won’t find with online banks, like safety deposit boxes. It’s okay to use more than one financial institution to meet your needs. Optimize what’s available to you to ensure your banking options are flexible but affordable.

Cheers to financial wellness 🥂! Want to fight debt and save more money? Here’s why you should start investing, even if you’re terrified; your guide to negotiating what you want at work; and why we need to talk about salary (and how to do it).